Three takeaways from earnings season

- 05.09.25

- Markets & Investing

- Commentary

Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- Tariff and economic uncertainties muddy the waters

- Consumers remain in good shape despite declining confidence

- Mega-cap tech 1Q25 earnings remained a bright spot

The roller coaster continues! A stronger than expected first quarter earnings season and encouraging signs on the trade front—highlighted by the US-UK trade deal—helped lift the S&P 500 from its April 8 near-bear market lows, reversing nearly all post-Liberation Day (April 2) losses. Corporate America has shown surprising resilience despite rising negative sentiment driven by concerns over tariffs and the broader economic outlook. Still, it’s too early to celebrate: the full impact of tariffs on profits and the real economy have yet to emerge. Many companies flagged ongoing uncertainty in these unprecedented times, with some withdrawing earnings guidance for the rest of the year. With ~85% of S&P 500 market cap having now reported and 1Q25 earnings season winding down, we highlight three key takeaways and share what we’ll be watching in the weeks ahead.

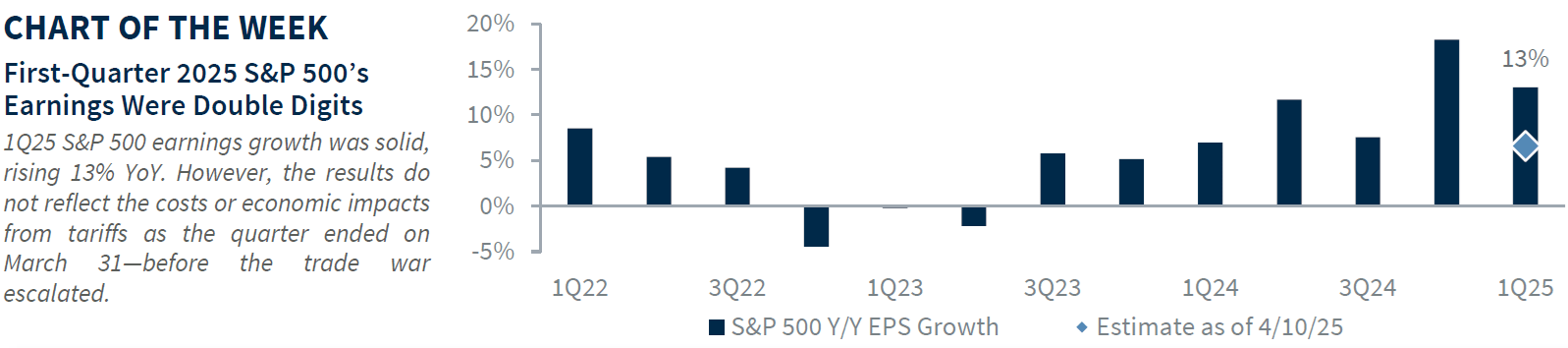

- Solid 1Q25 Earnings Results, But That Doesn’t Tell The Whole Story | 1Q25 EPS growth is tracking at ~13% YoY—nearly double the 7% forecast at the start of earnings season (April 1). It's important to note that the trade war escalation (Liberation Day was April 2) occurred after the first quarter ended so its earnings impact has been minimal so far. Here are our three key takeaways from this quarter’s earnings season:

- Tariffs And Economic Uncertainties Muddy The Waters | While 1Q25 earnings results were solid, they’re now largely outdated. Since the quarter ended on March 31—before the trade war escalation—the reported figures don’t yet reflect the costs and economic impact of new tariffs. Notably, more than 90% of S&P 500 companies mentioned ‘tariffs’ on their earnings calls, and approximately 30% referenced 'recession,' up from 3% last quarter. These concerns have driven sharp downward revisions to future earnings. Despite Q1 earnings growth estimates being revised up to 13%, full-year 2025 EPS forecasts have been cut by ~4% to around $264. Looking ahead, as tariffs weigh on both demand (sales growth) and pricing power (margins), we expect further downward revisions to our $250–$255 range.

- Current State Of The Consumer | Declining consumer confidence has raised concerns about future spending. However, banks emphasized that consumer fundamentals remain solid, while credit card companies (Visa and Mastercard) reported an acceleration in spending through April. Some retailers, like Amazon, noted that tariffs have yet to materially affect consumer spending patterns. However, early signs of strain are emerging. Restaurants, often an early indicator of shifting consumer behavior, are beginning to show signs of pressure. Several chains reported weaker same-store sales, particularly among lower-income consumers who tend to cut back on dining out first. Even among higher-income households, some premium dining establishments noted a moderation in demand. Similarly, airlines and high-end retailers are beginning to report softening trends, suggesting a more cautious tone more broadly. We expect the labor market to remain healthy, which should support continued—though slower—growth in consumer spending through 2025. Still, the emerging cracks in both lower- and higher-income segments will be important to monitor as the year progresses.

- Mega-Cap Tech Stays Resilient| Mega-cap tech started the year on a weak note, with a composite of names (e.g., MAGMAN*) down 11% YTD—the second worst start since 2008—amid concerns over high valuations, rising Chinese AI competition, and trade/tariff tensions. However, Q1 earnings eased those worries: EPS growth remained strong, with mega-cap tech earnings growth on track to rise 31% and outpace the broader market each quarter through 2026; five of six MAGMAN companies that have reported thus far beat estimates by 14%, marking the best performance since 3Q23. Valuations relative to the S&P 500 are now at their lowest since 2017, reinforcing the sector’s appeal. Investment also stayed strong, with capex up 5% QoQ and projected to grow 33% YoY, signaling continued confidence despite competitive pressures. Meanwhile, AI momentum is accelerating—mentions on earnings calls hit a record high, and cloud growth remains solid, pointing to expanding adoption. Altogether, Q1 results reaffirm our overweight stance on mega-cap Tech.

- Retailers Will Be In Focus In The Weeks Ahead | As 1Q25 earnings season winds down, investor focus shifts to upcoming reports from major big-box retailers like Walmart, Target, Home Depot, and Lowe’s. These earnings are particularly significant as they include April—the first full month under the new tariff regime—offering an early look at how companies are adjusting post-Liberation Day. Key themes to watch include how retailers are managing supply chains in the face of new trade dynamics, whether current inventory levels are sufficient to avoid potential summer shortages/empty shelves, how pricing strategies are evolving in response to tariff pressures, and whether there are any early signs of shifts in consumer behavior. These reports will provide valuable insight into how the retail sector is navigating this new environment.

The Bottom Line | Better than expected 1Q25 earnings have fueled the S&P 500’s sharp rebound from its April 8 lows. However, it's important to keep in mind that these results are backward-looking. While consensus 2025 earnings estimates have steadily declined—from over $272 at the start of the year to around $264—further downward revisions are likely amid ongoing growth headwinds and tariff-related uncertainty. However, our view that a recession will be narrowly avoided supports our $250-$255 EPS and 5,800 year-end S&P 500 targets.

All expressions of opinion reflect the judgment of the author(s) and the Investment Strategy Committee, and are subject to change. This information should not be construed as a recommendation. The foregoing content is subject to change at any time without notice. Content provided herein is for informational purposes only. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Past performance is not a guarantee of future results. Indices and peer groups are not available for direct investment. Any investor who attempts to mimic the performance of an index or peer group would incur fees and expenses that would reduce returns. No investment strategy can guarantee success. Economic and market conditions are subject to change. Investing involves risks including the possible loss of capital.

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Diversification and asset allocation do not ensure a profit or protect against a loss.